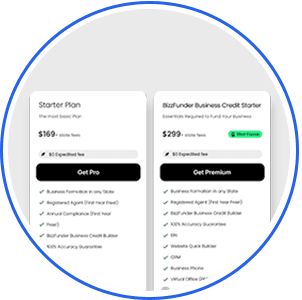

The Most Basic Plan

Essentials Required to Fund Your Business

Yes. C Corps pay corporate tax, and shareholders pay tax again on dividends. However, it can be beneficial if you’re reinvesting profits or structuring for funding.

Yes — but it’s best to form it as a C Corp from the beginning if you know funding or shares are in your future.

Not necessarily. We provide legally sound documents and compliance tools to help you avoid costly attorney fees.

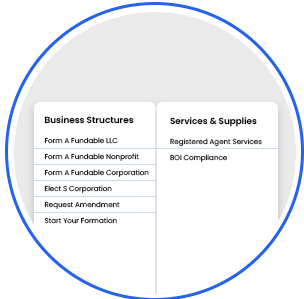

Yes, but you’ll need to register as a foreign corporation in each additional state.

Absolutely. And we’ll help you build it using our BizzFunder platform.